Real Estate investment success hinges on managing operating expenses, encompassing mortgages, taxes, utilities, and maintenance. Categorizing these into essential areas like rent, salaries, and administrative costs enables strategic decision-making. Accurate budgeting, leveraging historical data and real estate software, ensures healthy cash flow in a dynamic market. Proactive adjustments maximize profitability by staying responsive to changing conditions.

In the dynamic realm of real estate, accurate budgeting for operating expenses is a game-changer. This comprehensive guide delves into the intricate world of real estate operating costs, providing a detailed understanding of various expense areas. By categorizing costs and implementing effective budgeting strategies, investors can optimize cash flow and ensure sustainable financial management. Discover practical insights on navigating and managing these expenses to foster successful real estate ventures.

Understand Real Estate Operating Expenses: A Comprehensive Guide

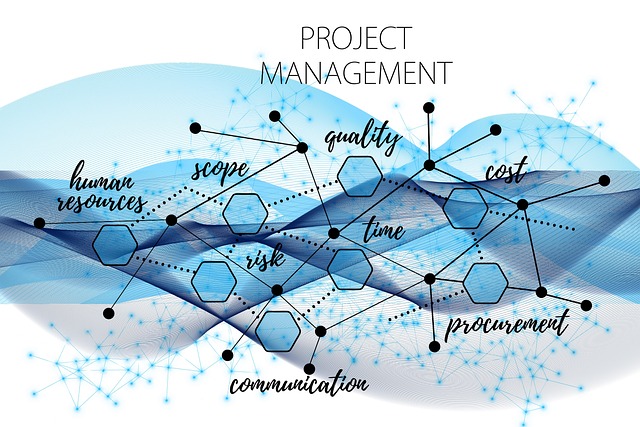

Real Estate operating expenses encompass a wide range of costs directly related to managing and maintaining properties. These expenses are vital for investors and property managers to accurately budget and ensure profitable real estate ventures. From mortgage payments and property taxes to insurance, utilities, and maintenance, each aspect contributes to the overall operational cost. Understanding these expenses is crucial for effective financial planning in the real estate sector.

A comprehensive guide to navigating Real Estate operating expenses involves meticulous tracking and analysis. Property owners should examine historical data, consult industry standards, and factor in unique property characteristics. Regular reviews are essential to stay on top of market fluctuations and optimize budget allocation. By breaking down these costs, investors can make informed decisions, maximize returns, and successfully manage their real estate portfolios.

Categorize Costs: Unraveling Common Operating Expense Areas

Categorizing costs is a crucial step in accurately budgeting for operating expenses. Common areas of operating expenses include rent or mortgage (a significant component, especially for businesses located in desirable real estate areas), utilities like electricity and water, internet services, employee salaries and benefits, office supplies, equipment maintenance, advertising, and administrative costs such as accounting and legal fees.

Understanding these expense categories allows business owners to make informed decisions about where to cut costs and where to allocate resources. For instance, negotiating better lease terms or exploring alternative energy providers can significantly impact overall operational costs. By meticulously reviewing and categorizing expenses, businesses can identify areas of improvement, enhance financial efficiency, and ensure sustainable growth.

Develop Accurate Budgeting Strategies for Optimal Cash Flow

In the dynamic realm of real estate, effective financial management is key to success. Developing accurate budgeting strategies is a fundamental step in ensuring optimal cash flow, which can make or break a business. Start by meticulously analyzing historical financial data and market trends specific to your region. This provides a solid foundation for forecasting expenses related to property acquisitions, maintenance, taxes, and operational costs.

Implementing technology solutions like specialized real estate software can streamline the budgeting process. These tools enable you to track expenses, identify patterns, and make informed decisions. Regularly reviewing and adjusting budgets based on actual performance is crucial. This proactive approach ensures that your financial strategies remain aligned with market dynamics, maximizing profitability while minimizing cash flow disruptions.