Landlords can maximize long-term success in real estate by combining strategic market understanding with strong tenant relationships and proper property upkeep. Staying informed about economic shifts, demographic changes, and local development is key to adapting investment strategies, managing rental rates, and deciding on necessary upgrades. Location and property condition are critical factors for retaining value and attracting tenants, ensuring stable cash flow and profitability over time.

In today’s dynamic real estate market, preserving a landlord’s investment over the long term requires strategic foresight. This article explores proven strategies to ensure your property portfolio stands the test of time. We delve into understanding market trends that shape property values, highlighting the crucial role of location and property condition. Key factors for landlords include effective management, regular maintenance, and strategic rent adjustments. Additionally, we provide tips on building a sustainable portfolio through diversification, fostering reliable partnerships, and leveraging technology for data-driven decisions.

Understanding Long-Term Investment Strategies in Real Estate

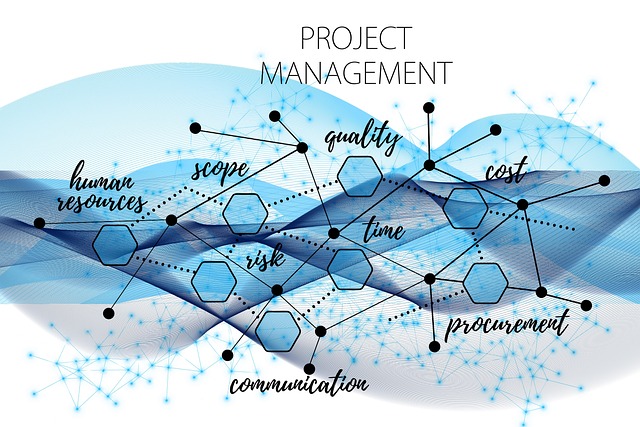

In the realm of real estate, landlords often strive to preserve and grow their investments over time. Long-term investment strategies in real estate involve a thoughtful approach that considers market trends, tenant satisfaction, and property maintenance. By focusing on these aspects, landlords can ensure their properties remain valuable and profitable for years to come.

Understanding the local real estate market is key. This includes staying informed about demographic shifts, economic developments, and emerging trends that might impact rental demand and property values. Regularly evaluating and adapting investment strategies allows landlords to make informed decisions regarding rent adjustments, property upgrades, or even diversifying their portfolio. Such proactive measures contribute to the overall longevity of their real estate investments.

– Market trends and their impact on property values over time

In the dynamic realm of real estate, understanding market trends is paramount for landlords aiming to preserve their investment over the long term. Property values are influenced by a myriad of factors, including economic conditions, demographic shifts, and local development patterns. Staying abreast of these trends allows landlords to make informed decisions regarding property management and potential upgrades, ensuring their assets remain competitive in an ever-evolving market.

Market fluctuations can significantly impact rental rates and property values over time. For instance, strong economic growth often leads to higher demand for housing, driving up both rents and property prices. Conversely, economic downturns may result in reduced occupancy rates and potential declines in property values. Landlords who adapt their strategies based on these trends can better protect their investment, ensuring long-term stability and profitability in the real estate market.

– The role of location and property condition in preserving investment

In real estate, location is a key factor in preserving a landlord’s investment over the long term. Properties situated in areas with strong economic growth prospects, robust local communities, and desirable amenities tend to hold their value better. Easy access to schools, healthcare facilities, public transportation, and recreational areas can significantly increase a property’s appeal, ensuring consistent or even rising rental income. Moreover, well-maintained and modern properties are more likely to attract tenants, allowing landlords to command higher rents and reduce vacancy rates.

The condition of the property also plays a crucial role in long-term investment preservation. Regular upkeep and renovations can extend the lifespan of the asset and mitigate unexpected repairs or significant upgrades needed later. A property that is aesthetically pleasing, functional, and meets contemporary standards not only becomes more marketable but also reduces the turnover of tenants. This, in turn, minimizes disruption to the landlord’s cash flow and helps maintain a steady return on investment.